We tax cigarettes so to discourage smoking, yet we want to simultaneously tax work and entrepreneurship while seeking to create more jobs and entrepreneurship. An alternative tax system could be based on a core principle where corporations and individuals should as far as possible be taxed not on the basis of what they produce, but on the basis of what they exclude others from. Such taxes are more fair, because in principle they are merely correcting for harms suffered by some individual based on the actions of others. They are also efficient, because they do not discourage any productive behavior, and indeed by disincentivizing damaging activity they may leave total welfare better off even before considering the revenue they generate. This article presents three taxes justified by this principle.

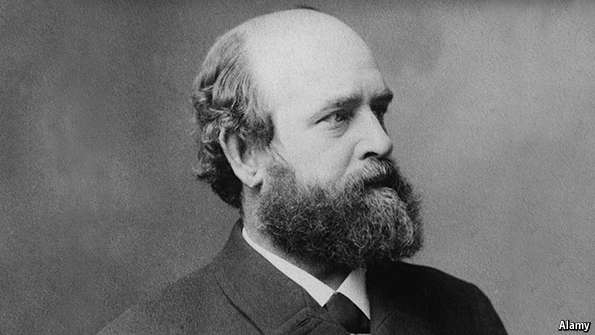

Henry George, wrote a book called “Progress and Poverty”, that sold more copies than any other book in the 1890s apart from the Bible. His main argument in the book was simple – that we should tax land. As he pointed out, “ tax capital, and there will be less capital; but you may tax land values all you please and there will not be a square inch the less land.” The appeal of a land tax is particularly strong because it is hard to avoid. One of the major challenges in taxing corporations is determining precisely where corporate profits take place, as the tax burden is supposed to be assigned based on the location of the economic activity, but there are bound to be complications, especially as more of the economy is conducted digitally without a clear physical geographic location.

With land, there is no such ambiguity (except in the case of disputed territories) – a tax on land values does not change based on the technical residents of the land’s owner. A Canadian company buying a mall in Seattle would pay taxes on that ground the same as any other owner, and if they ‘inverted’ and based themselves in Ireland, it would make no difference to the taxes they owed King County in the current property tax system – that’s one beauty of a land tax. The other is that, if taxes were levied based on the value of land, rather than (as is currently the case in most jurisdictions) on the overall property value, there would be no discouragement to any productive activity. If you renovate your house and make it more valuable, your tax burden would not increase. In fact, landowners would be more likely to develop their land, since their overall tax burden would be the same if they built a condo complex or left an unpaved parking lot. This allows for land taxes to be collected by smaller jurisdictions, like municipalities and counties, and allows those areas to collect taxes at whatever rate is optimal for them, without having to fear ‘driving out’ their tax base – any tax flight that occurs simply frees up land for other users. Because holding land is essentially keeping something from the community, not producing something in it, tax flight is not nearly the threat it is in a system reliant on taxing capital or income.

Intellectual property is another such category of property. To be sure, IP is created, in the sense that books are written, inventions discovered, and so on – one would not want an IP tax to be so high that it made patent protection or copyrights entirely unprofitable. But at its core, a patent or copyright constitutes a legal right to exclude another person or entity from economic activity in an intellectual space, just as land ownership excludes others from physical space. And just as a land value tax would encourage underused property to be sold or leased out to someone who could make it more productive, a tax on intellectual property could do the same, as well as quashing patent trolling, evergreening, and other attempts at IP rent seeking. The revenue raised could also be used to fund other kinds of technologies like antibiotics, which under the current IP regime are not given adequate investigation because their societal benefits are difficult to turn into revenue.

And despite being by definition immaterial, IP actually has strictly defined borders – at least, the rights conferred by it do. Although efforts have been made to agree on universal standards for registering and enforcing IP, doing so is still a function of national governments, and IP rights are commonly divided between countries. Thus, a company like Apple, which has a distinct interest in protecting its IP around the globe, might be expected to pay a substantial tax for that privilege in the US, where those rights are very valuable, and a somewhat smaller tax in Australia, where the smaller market means that enforcing the IP leads to less revenue. International cooperation would be needed to harmonize rates, but the key component of such a tax would be that it would be based on the enforcement of IP ownership (ie, the exclusion of others from using the technique, technology, or copyright in question) in a particular area, as opposed the place the patent was original registered or the nationality of the patent holder. This would avoid techniques like registering IP to subsidiaries in Ireland – a popular move by tech companies, given that Ireland charges a much lower rate on income derived from IP than other kinds of income.

One potential difficulty arising with IP is the question of valuation. Land valuation is done primarily by comparing market prices for available lots, and while purchase prices may be distorted by higher land value taxes, it is still possible to compare leasing prices and other data to determine at least the relative values of different plots of land. Intellectual property is more difficult because each piece is unique and by definition novel, and it is often unclear what its close analogues are.

Fortunately, firms make these kinds of assessments all the time, and a clever sort of tax called a Harberger Tax can be used to take advantage of this. A Harberger Tax, simply put, asks an asset owner for their own evaluation of the asset’s value, and taxes based on a percentage of that value. However, that evaluation then becomes a binding price for whoever would want to purchase the good. For example, a company could value their IP to be worth only $1 to pay less taxes – but then they would risk someone else coming along and buying it for $1. This could lead to some problematic complications in the case of physical assets, making investments difficult to hold on to and creating some incentive for firms to deprive competitors of assets maliciously. For IP, however, the situation is substantially different: because intellectual assets are non-rival (one firm using the property doesn’t inhibit anyone else’s ability to use it), the asset price set for the tax could be applied both to licensing prices and potential damages in court without inhibiting the asset owner’s ability to use the good.

For example, imagine a new blood pressure drug is patented. The market is presumed to be large, so the patent is listed as having a value of $5 billion in the United States and $500 million in Canada. Under a Harberger Tax regime applied to intellectual property, the pharmaceutical company holding the patent would pay perhaps 25 million a year (.5%) to maintain those exclusive rights in the United States, and the $2.5 million to maintain the rights in Canada. Another firm wanting to produce the same drug would then have the legal right to pay $500 million to attain equal rights to market the drug in Canada, since that’s the listed value of those particular rights – but the original firm would not lose that right, meaning the cost of the given drug in the country in question would almost certainly fall. Moreover, infringement on the property could also be penalized in civil court based on multiples of the actual property’s value, simplifying the role of civil courts in trying to assess competing claims for damage. This would encourage accurate assessments from firms, since over-assessing increases their tax liability, and underassessing limits how strongly they can defend their patent. It would also create an incentive to allow licensing of such properties and streamline negotiation for selling various country-specific rights, since prices that normally have to be investigated and negotiated would be public record.

Such a system has been proposed for all manner of assets, for precisely these reasons. – notably by economists Eric Posner and E. Glenn Wyle, who argue that property always implies monopoly and thus some correction for the monopoly power of owners is needed for economic efficiency. Indeed, a limited application to land value is also possible, by requiring that tax assessment values also be binding for eminent domain claims by the government. Applying it to rival goods creates a host of complications however, including concerns about malicious use by competing firms as well as the deadweight loss from discouraging investment. But intellectual property is one case where property really does imply monopoly – indeed, owning a patent is nothing more than owning the right to prevent others from taking some action or making a certain good. And the fact that intellectual property is non-rival makes it an ideal candidate for such a tax. Properly set, this tax could not only correct for the inefficiencies inherent in the monopolies created by patents and copyrights, but also raise revenue for governments to do research in critical areas that might be less profitable but have strong positive externalities, like anti-biotics. It could also streamline the currently authoritarian process by which governments take control of critical patents; rather than having to invoke national emergency or defense clauses to speed up the production of a critical piece of patented equipment, for example, governments could simply buy the rights to it in their country and open up production to competing firms. Making any of this possible, of course, would require re-working the global intellectual property system. However, given that the negotiations to make that possible would in fact be returning more sovereignty to individual states and reducing corporate power would hopefully smooth the discussions considerably, as international intellectual property rights are currently among the most controversial elements of the free trade agenda.

Finally, one kind of economic activity has truly global externalities – the release of carbon dioxide. By contributing to global climate change, fossil fuel burners effectively exclude the entire population of the world from the climate we are currently enjoying, contributing to potentially trillions of dollars in destruction from weather events, agricultural failures, and mitigation efforts. Unlike taxes on land and IP, a carbon tax would, hopefully be only a temporary source of revenue, as the economy ‘decarbonizes’. For now, however, it is a good example of a truly global issue, and of economic activity that humanity as a whole has an interest in discouraging. A single country may pass a carbon tax and link it with a carbon tariff in an effort to avoid simply displacing high polluting industries to other countries. This nonetheless creates complications because it is very difficult to track precisely the carbon that goes into different products. Suppose a carbon tax and tariff raises the price of farming, since a great deal of fuel is used in the process. Should imports of wheat then be taxed? If higher energy prices encourage server farms to move outside a country’s borders, can the state effectively tax data flow or cloud services?

The answer to these and other questions is unclear – and certainly rests a great deal on state capacity, making it unrealistic for states already burdened with collecting more straightforward taxes. Carbon taxes *should* be adopted by those wealthy countries that can afford them, but the best solution is a global carbon tax and dividend system – one which ensures that all industrialized countries are collecting a tax on carbon at high enough level to promote a shift to cleaner technologies, and ideally coupling this taxation with grants to help current low emissions countries skip over the carbon intensive stages of economic development that were pivotal to the current economic prosperity enjoyed by developed countries.

No such system has ever been implemented, and the task appears daunting. However, the success of the idea of a global minimum tax on corporations in the OECD and other fora could mean that a sea change is underway. Compared to international corporate taxation, a global agreement to tax carbon is both more pressing and easier to implement. Hopefully this newfound enthusiasm for global taxation can be directed towards more efficiently taxing this most dangerous externality.

There are doubtless other categories of activity that might be reasonably taxed as well -there are other kinds of pollution, and other kinds of rent seeking. The principles laid out here, however, still basically apply: the best taxation is that which focuses on activities that harm others or properties that exclude them and are collected by a jurisdiction of the appropriate size to encompass them.

We are an online media cooperative owned democratically by the readers and the writers. Join us now and become a founding member. As a member you can vote for your favourite articles and we will distribute our funds accordingly.